Anúncios

Discover how to turn your daily purchases into amazing rewards!

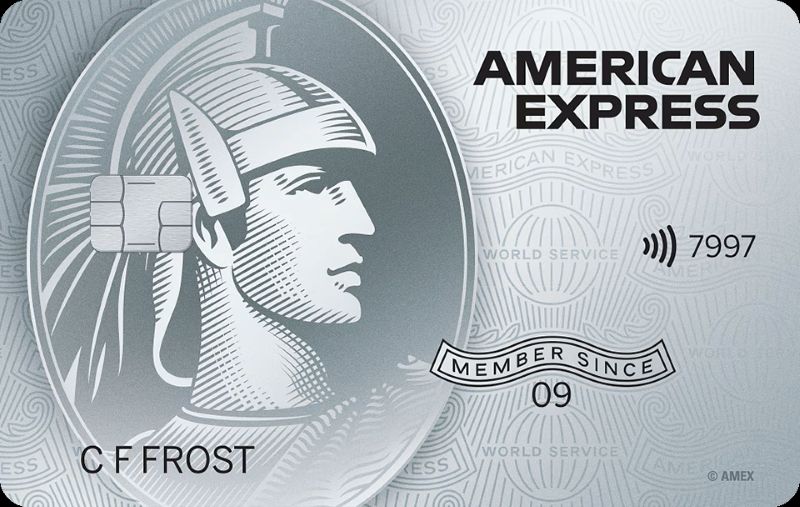

The American Express Platinum Cash Back Credit Card is an excellent choice for those seeking rewards on their purchases. Every expense turns into cashback.

This card offers more than just accumulating points. With every purchase, you get a percentage back, making your expenses even more beneficial.

Additionally, it comes with a range of exclusive benefits that make the experience of using it even more attractive, a practical way to maximize your value.

Curious to learn all about how it works? Discover what the American Express Platinum Cashback Credit Card is and how it can transform your purchases.

What is the American Express Platinum Cashback Credit Card?

Obtaining a cashback credit card is an attractive option for individuals seeking to recoup a portion of their daily expenses.

With the American Express Platinum Cashback Credit Card, you accumulate a percentage of your purchases in cashback without the need for points.

Besides accumulating cash back, the card offers a variety of exclusive benefits, including access to promotions and special deals with various partners.

This card stands out for being easy to use, with clear benefits and no hidden fees. It’s an excellent choice for those looking to optimize their finances.

Main Benefits of the American Express Platinum Cashback Credit Card

A cashback credit card offers an effective way to earn financial rewards while making everyday purchases. It turns every transaction into an opportunity to earn.

The American Express Platinum Cashback Credit Card offers more than just basic cashback. It offers a variety of benefits that make every purchase even more valuable.

Attractive Initial Cashback

When you acquire the American Express Platinum Cashback Credit Card, you receive an initial 5% cashback on purchases for the first three months, up to £125.

This exclusive benefit enables you to maximize the value of your initial purchases. With every purchase made, the cashback is credited directly to your statement.

The initial cashback is a great way to test the card and see how beneficial it can be in your daily life. The more you use it, the more you earn!

The American Express Platinum Cashback Credit Card ensures your first few months are rewarding. It’s a great way to start saving right away.

Ongoing Cashback and Unlimited Accumulation

After the initial period, ongoing cashback is credited on every purchase made. You earn 0.75% on annual spending up to £10,000.

Furthermore, when you exceed £10,000 in spending, this percentage increases to 1.25%. In other words, you’ll always be rewarded in proportion to your spending.

The best part is that the American Express Platinum Cashback Credit Card has no limits on the total cashback you can accumulate annually.

This means you can continue accumulating cashback without worrying, making the most of the benefits with every purchase you make.

Annual Cashback

Each year, the accumulated cashback is credited to your statement. This payment happens automatically after the annual cycle closes.

The advantage of annual cashback is the feeling of reward when you see the total amount credited. It’s like a gift for your loyalty to the card.

The American Express Platinum Cashback Credit Card makes it easy to track your savings, ensuring transparency throughout the process.

This benefit wraps up the year efficiently, offering you more flexibility to spend and enjoy your financial return.

Fees of the American Express Platinum Cashback Credit Card

The American Express Platinum Cashback offers a great way to get financial returns, but like any financial product, it also comes with some fees.

The fees for the American Express Platinum Cashback Credit Card are clear. They are important to ensure you understand the true cost of using the card.

Accessible Annual Fee

The annual fee for the American Express Platinum Cashback Credit Card is £25; however, this fee may be waived for new customers in the first year. A great advantage!

With the annual fee, you gain access to all the card’s benefits, including cash back and exclusive offers. This makes the cost quite accessible in terms of the rewards.

By paying the annual fee, you ensure that all your spending can generate cashback without additional costs. This makes getting the card more advantageous.

If your annual spending is high, the annual fee may become practically insignificant compared to the benefits it provides. The rewards will compensate for the amount paid.

Interest Rates and Payments

The interest rate on the American Express Platinum Cashback Credit Card is 35.6% per year, which is the average for premium credit cards. This rate is variable.

It’s essential to pay off your bill in full within the due date to avoid interest charges. They apply to any balance that is not fully paid.

Additionally, if you only pay the minimum amount, interest on the remaining balance can quickly accumulate, increasing the cost of credit.

Therefore, to maximize the card’s benefits, it’s best to keep your payments up to date and avoid allowing interest to impact your finances.

Late Payment Fee

If you fail to pay the bill by the due date, a £12 late payment fee will be charged. This can impact your balance.

The American Express Platinum Cashback applies this fee to ensure timely payments are made. It helps keep the financial system in order.

This fee can be easily avoided with good financial organization and payment reminders. Keeping track of your statement is essential.

Avoiding the late payment fee is simple: just stay organized and pay before the due date. This protects your finances and ensures efficient use of your card.

Eligibility Requirements to Apply for the American Express Platinum Cashback Credit Card

To apply for the American Express Platinum Cashback Credit Card, it’s essential to meet a few basic requirements to ensure approval.

The bank requires you to have a good credit score, along with proof of income and residency in the country where the loan is issued.

Another important requirement is being over 18 years old and a resident in the UK, where the card is available to most customers. This makes the application process easier.

Before applying, check your financial situation. The bank’s analysis considers your ability to pay and your credit history in determining approval.

Step by Step to Apply for the American Express Platinum Cashback Credit Card

Credit Card

American Express Platinum

Applying for the American Express Platinum Cashback Credit Card is simple. Follow this guide to ensure approval.

- Check the Eligibility Requirements: Before applying, ensure you meet the requirements, including a credit score and proof of income.

- Fill Out the Application Form: Visit the American Express website and complete the application form with your personal and financial information.

- Submit the Required Documentation: Please send the required documents, including proof of income, ID, and address, for review of your application.

- Wait for Approval: After submitting all the details, wait for the credit review and confirmation of approval. This process can take a few days.

Now that you know the step-by-step process, you’re ready to apply for your American Express Platinum Cashback Credit Card with confidence.

Exclusive Protections and Benefits of the American Express Platinum Cashback Credit Card

The American Express Platinum Cashback Credit Card also offers a range of protections and exclusive benefits to ensure security and advantages for its users.

By choosing the American Express Platinum Cashback Credit Card, you’re opting for a comprehensive experience with additional benefits that make everyday use even more rewarding.

Purchase Protection

The American Express Platinum Cashback Credit Card offers protection that guarantees reimbursement or replacement of damaged or stolen products, up to £2,500.

This protection applies to products purchased within 90 days of purchase, offering greater security for consumers.

With this coverage, you can shop confidently, knowing that any issues will be covered by American Express, preventing unexpected losses.

Additionally, the purchase protection is automatic, with no extra costs, making the card even more attractive for those seeking added security for purchases.

Travel Accident Insurance

By using the American Express Platinum Cashback Credit Card to pay for your trip, you receive travel accident insurance coverage, providing protection in the event of unforeseen events during your journey.

This insurance covers medical expenses and personal damage in the event of accidents during international travel, ensuring a safer and smoother trip.

The coverage includes not only accidents during transport but also unexpected events that may occur while you’re traveling, whether for business or leisure.

With this insurance, the card becomes even more advantageous for frequent travelers, providing greater security and support throughout the journey.

Access to Amex Offers

The American Express Platinum Cashback Credit Card offers exclusive access to Amex Offers, which are special cashback promotions and discounts with various partner stores and services.

These offers enable you to save even more on your daily purchases, including discounts at restaurants and supermarkets and even on travel expenses.

By activating the offers, you can maximize your rewards while taking advantage of promotions that can lower your costs.

This makes using the card even more beneficial, with opportunities to save on products and services you already use regularly.

Amex Experiences

With the American Express Platinum Cashback Credit Card, you gain access to exclusive events through the Amex Experiences program, including early access to tickets for shows and sporting events.

These experiences offer unique opportunities to enjoy special moments, whether through exclusive tickets or VIP access at events.

Program members can enjoy invitations to private events, tastings, and other exclusive experiences as part of the American Express offer.

This benefit makes the card stand out even more, providing not only financial rewards but also access to unique and unforgettable moments.

Conclusion

The American Express Platinum Cashback Credit Card is an excellent choice for those seeking rewards on their daily purchases, offering cashback and exclusive benefits.

With an accessible annual fee and ongoing cashback, the card provides real advantages on your purchases, turning each transaction into an opportunity to save.

Additionally, the purchase protection and travel insurance ensure greater security and peace of mind, making the card even more valuable to use.

Liked it? Want to explore more credit card options with great benefits? Check out the article below and discover the perks of the British Airways Amex Premium Plus!

Recommended Content