What if the money you needed came just in time?

The Santander personal loan could be the opportunity you’ve been waiting for!

Advantages and Disadvantages of the Santander UK Personal Loan

If you’re considering taking out a personal loan in the UK, Santander UK offers several advantages. However, it’s essential to understand all aspects before making a decision.

Below is a detailed analysis of the main benefits and drawbacks of the Santander personal loan, based on the bank’s official information.

Benefits of the Santander UK Personal Loan

- Fixed and predictable interest rates: Interest rates remain fixed throughout the loan term, offering predictable monthly repayments and helping with financial planning.

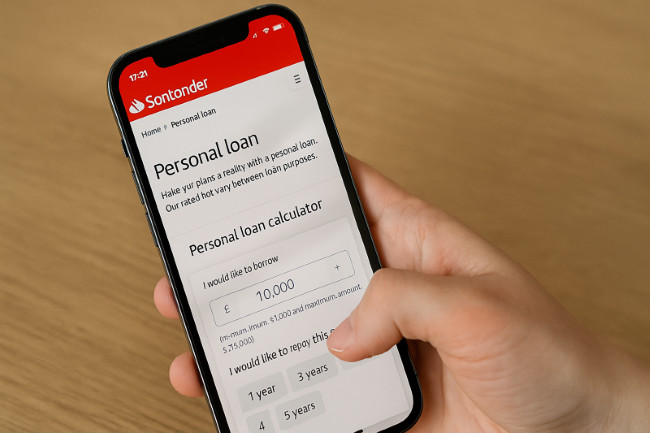

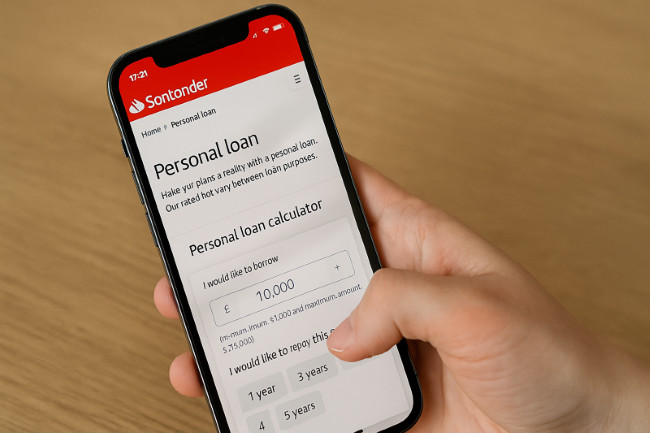

- Fast and fully online application process: You can apply online, and a decision is usually made within five minutes. Additionally, the initial loan quote does not affect your credit score.

- Flexible loan amounts and terms: You can borrow between £1,000 and £25,000, with repayment terms from 1 to 5 years, allowing you to tailor the loan to your financial goals.

- Option for early repayment: You can make early repayments or pay off the loan in full before the end of the term. Sometimes, up to 30 days’ interest may be charged as a fee.

- Incentive for sustainable home improvements: Customers using the loan for eco-friendly home upgrades may be eligible for a £1,000 cashback, promoting sustainable living practices.

Drawbacks of the Santander UK Personal Loan

- Strict eligibility criteria: You must be over 21, permanently reside in the UK, and have a minimum annual income of £10,500 (for loans up to £19,999) or £20,000 (for loans between £20,000 and £25,000).

- Credit impact if repayments are missed: Late or missed payments can negatively affect your credit score and may lead to legal action for debt recovery.

- Usage restrictions: The loan cannot be used for specific purposes, such as purchasing property, making investments, paying tax liabilities, or repaying student debt.

- Activation code sent by post: Once approved, you’ll need to wait for an activation code to be delivered by post before accessing the funds, which may delay availability.

Conclusion

The Santander UK personal loan is a solid choice for those seeking clear terms, fixed rates, and repayment flexibility. However, it is crucial to ensure that you meet the eligibility requirements and that the loan fits your financial needs.

Before making a final decision, consider both the advantages and disadvantages presented. I can help you simulate different loan scenarios or provide additional information to support your financial decision-making.

Discover How a Santander Personal Loan Can Bring Your Plans to Life

Have you ever imagined finally starting that project you’ve been putting off for months, or getting out of the stress of mounting debts? The Santander personal loan could be the ideal solution for anyone seeking financial balance, freedom of choice, and no unnecessary bureaucracy, just the right credit, at the right time.

With a 100% online application process, you can simulate your loan, choose the amount and term that best suits your budget. The interest rates are fixed, meaning you’ll know exactly how much you’ll pay from start to finish. All this with the security and reliability of one of the UK’s most trusted financial institutions.

The funds can be used however you wish, whether to get your finances in order, renovate your home, invest in a course, or even buy a car. Best of all: the process is fast, with a decision made within minutes of applying. You stay in full control and can plan each step with confidence.

If you’re looking for simplicity, autonomy, and transparency, a Santander personal loan could be the boost you’ve been waiting for. Don’t keep putting off your goals due to a lack of accessible credit. Simulate your loan now, explore the available terms, and take the next step with confidence. Your moment to move forward begins with one simple decision.

Site