Anúncios

Find out how to use the loan to bring your plans to life, with no hassle.

The Santander personal loan allows you to request between £1,000 and £25,000 with fixed rates and repayment terms from 1 to 5 years.

This type of credit can be used for several purposes, such as home improvements, car purchases, or consolidating existing debts into one payment.

The process is simple for eligible clients, with quick responses and a fully online application, with no collateral required or unnecessary bureaucracy.

Do you want to understand how to apply for a Santander personal loan safely and easily? Discover now how to take this step with confidence.

Learn how the Santander UK Loan works.

In the UK, Santander’s loan is available for amounts from £1,000 to £25,000, with fixed interest and repayment terms from 1 to 5 years.

Eligible customers can apply online and receive a decision in as little as five minutes, without affecting their credit rating during the simulation.

Once approved, the customer receives an activation code by post. After entering it online, the money is transferred to their Santander current account.

The loan can be used for various personal purposes, except for business, investments, property, taxes, student loans, or legal expenses.

Who can apply for a Santander personal loan in the UK?

To apply for a Santander loan in the UK, you must live in the country, be over 21, and have a regular, provable income.

To increase your likelihood of approval, you’ll also need an active current account with Santander UK and a good credit history.

The Santander personal loan is for individual use only. The approved amount depends on the credit assessment done during the online application.

Those in default, bankruptcy, or with financial restrictions are unlikely to be approved for this type of personal credit.

What documents are required during the application?

To apply for a loan in the UK, you’ll need your full address history from the last three years and your current employment details.

You’ll also be asked for your bank account number and sort code, which are needed to set up the direct debit properly.

The Santander personal loan requires information about your annual income and job status, whether employed, self-employed, or retired.

Sometimes, the bank may request additional documents to verify your identity or clarify information provided during the online application.

See how much money you can borrow with Santander UK.

The Santander loan in the UK offers between £1,000 and £25,000, with full flexibility for personal projects or financial needs.

Repayment terms range from 1 to 5 years, allowing you to choose monthly payments that fit your budget and timeline.

The Santander personal loan features fixed interest and an online application, giving you total control and predictability throughout the contract.

Before applying, simulate various amounts and durations to find the best combination for your financial profile and monthly capacity.

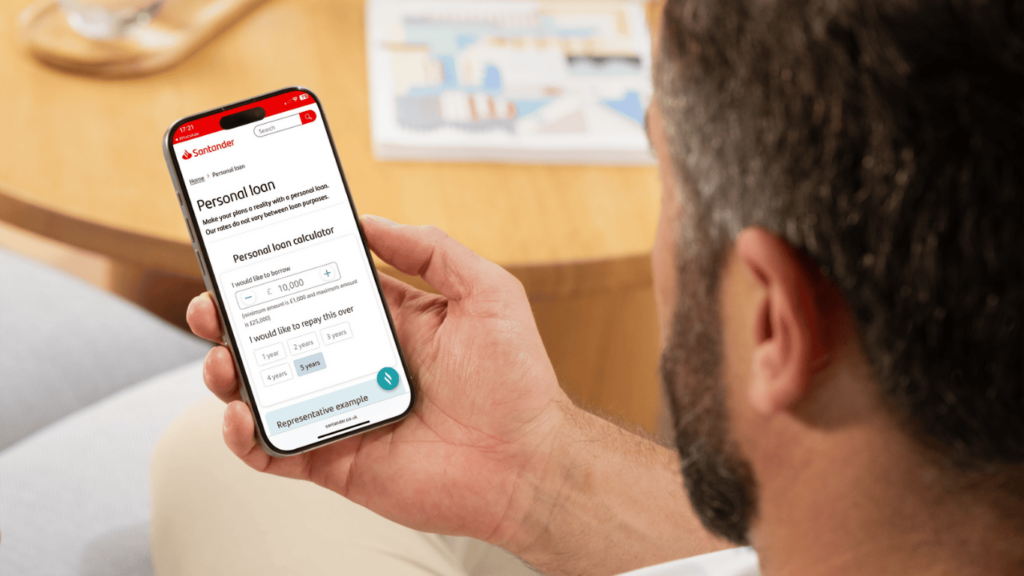

Simulate your loan now with the Santander UK simulator.

In the UK, simulating a Santander loan is fast and helps you understand real options before making a final decision.

- Click “Simulate now!” to access the official Santander UK loan page and start your simulation.

Site

- Based on your selections, fill in your desired amount and term to see how monthly repayments change.

- Enter your financial and personal details so the simulator can generate a tailored estimate for your profile.

- Review the information shown, including representative APR, total repayable, and monthly payments based on your input.

A Santander personal loan simulation is safe and does not impact your credit score, so it is ideal for confident planning.

See how to get the best rates on a Santander UK Loan.

In the UK, to access better rates on a Santander loan, it’s essential to understand how APR works and how your financial profile affects the outcome.

The representative APR reflects the total cost of the loan per year and changes depending on your credit history and risk profile.

Applicants with a strong credit history often receive lower interest rates because they represent less risk to the bank.

Before applying, check your credit rating, organise your finances, and simulate options to increase your chances of getting the best rate.

Loan approved in minutes? Learn how the process works.

The Santander UK loan process is fast, secure, and fully digital. You can apply online and receive a quick response.

With just a few clicks, you start the simulation, complete your details, and view tailored loan offers based on your current financial situation.

How to apply 100% online and receive a quick response

The process begins with a simple simulation on the Santander website. Choose your amount and term, then enter basic financial details.

Once you’ve filled in your information, the system analyzes your profile and tells you whether you’ve been pre-approved for your chosen amount.

The Santander personal loan can be approved in five minutes, provided you meet the eligibility criteria.

If approved, you’ll receive an activation code by post. Enter it online, and the money will be transferred to your account.

Does Santander perform a credit check without affecting your score?

During the simulation, Santander performs a soft credit check that does not impact your credit score.

This allows you to test different scenarios safely, without damaging your financial history.

A full credit check only happens after you accept the final loan offer and proceed with the formal agreement.

This gives you more freedom to compare loan conditions before committing to the Santander personal loan.

How to track your application status via the app

Once you’ve applied for a Santander personal loan, you can track your application status directly through the Santander UK mobile app.

Log in to your account, go to the loans section, and check for updates regarding approval, documents, or any pending steps.

The app sends real-time notifications for every stage, from initial review to final fund release in your account.

This feature gives you full control and peace of mind, without needing to call or visit a branch.

Santander loan for cars, home improvements, or debt? Discover what suits you.

In the UK, a Santander loan can be used flexibly to buy a car, renovate your home, or manage debts more effectively.

Using the credit wisely helps you stay in control and turn your goals into achievements with proper planning and structure.

How to use the loan to buy your car now

A personal loan is quick for financing a new or used car—no down payment or vehicle collateral is required.

With a Santander personal loan, you keep ownership of your car and are free to sell or exchange it as needed.

The available amounts let you finance the vehicle completely, with flexible terms and repayments to suit your financial routine.

Just simulate online, choose your amount, and complete the process to receive a quick response from Santander.

Home improvements? Learn how to use personal credit wisely.

If your home needs improvements, a personal loan can cover everything from painting to furnishing or new installations.

Santander UK offers suitable amounts and terms with fixed rates, ideal for renovation projects of different sizes.

You don’t need to show quotes or prove how to use the funds — the process is simple and trust-based.

Plan carefully and simulate options to ensure the monthly payment fits comfortably within your current budget.

Debt consolidation: turn five bills into just one

The Santander personal loan can consolidate several debts into one manageable monthly payment, reducing stress and simplifying your budget.

Consolidating often lower interest rates than credit cards or other short-term loans.

You may include credit card balances, overdrafts, or old loans if the total is within Santander’s lending limits.

Simulate and compare whether consolidating will save you money overall and help you regain financial stability.

Conclusion

In the UK, the Santander personal loan is a practical option for those seeking more financial structure without giving up freedom or convenience.

With flexible usage, an online application, and fixed rates, you have more control over planning, investing, or solving what’s holding you back.

Before moving forward, always review conditions calmly and check if the loan aligns with your income and goals.

Enjoyed the tips? Want more ways to improve your financial journey? Check out the article below and explore everything about the Chase Credit Card!

Recommended Content